As published in Synergyzer Annual 2021

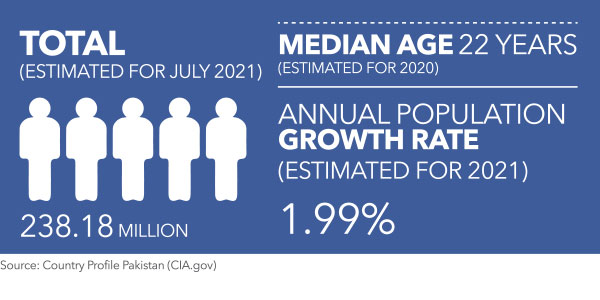

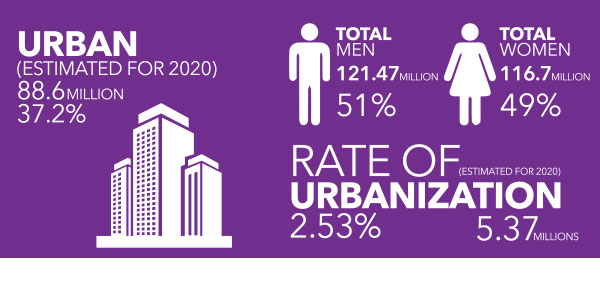

POPULATION

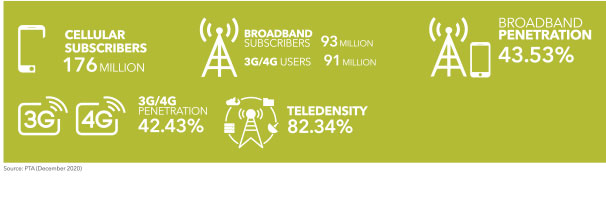

TELECOMMUNICATION STATS

CELL PHONE AND INTERNET USERS

FINANCIAL INCLUSION AND PAYMENT SYSTEMS

- During July to September 2020, the currency in circulation has shown a 16% growth which implies growth in GDP.

- Due to the incidence of COVID-19 and resulting lockdowns, most banks promoted their digital banking products including mobile apps and wallets.

- Debit cards usage has shown a sharp surge during Q1 2021 however, the value of transaction is still higher for credit cards, which have limited penetration in the Pakistani market.

E-COMMERCE IN PAKISTAN

- There is a catalytic impact of COVID-19 on the growth of mobile banking and e-commerce. A surge of 36% in e-commerce is also reflected by the growth of e-commerce merchants.

- Credit cards and Debit cards have shown a growth of 4% over the last year. The number of e-commerce merchants grew by 63%. The value of transactions has also increased by 47% and the number of transactions has grown by 58%.

- The number of transactions using debit card are almost double (5.80 million) as compared to the number of transactions done using credit cards (2.80 million).

- This also implies that the average size of transaction done using credit cards is much bigger as compared to the size of transaction done using debit cards; as there are only 1.6 million credit card users in Pakistan in comparison to 27 million debt card users.

- However, higher growth of 93% amongst ecommerce transactions using debit cards show the expansion in e-commerce users in Pakistan.

The growth in the value of transactions for mobile banking is 192% over last year; as compared to 76% growth in internet banking.