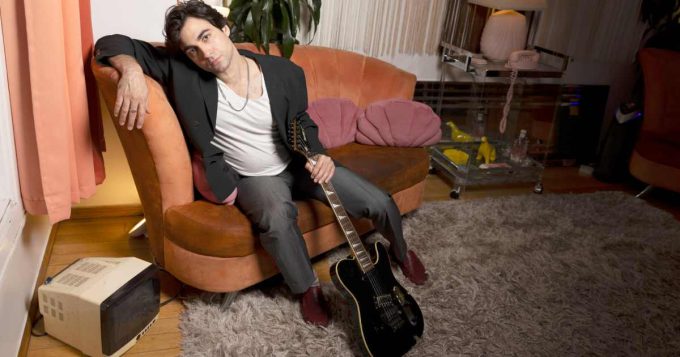

Managing Director and Head of Wealth & Retail Banking at Standard Chartered Pakistan

Saadya Riaz, Managing Director and Head of Wealth & Retail Banking at Standard Chartered Pakistan, is leading a transformative shift in the industry. With over two decades of experience across Asia, the Middle East, and Africa, she advocates a client-first approach that merges digital innovation. Under her leadership, the bank is redefining wealth, empowering customers, and encouraging agility within a highly regulated landscape, all while keeping people at the centre of progress. Join us as we explore her vision.

Synergyzer: How has your retail and wealth strategy evolved in response to changing customer expectations and digital disruption?

Saadya Riaz: I believe we are at a crucial juncture for retail banking in Pakistan, with the landscape poised for significant transformation across key dimensions. For those willing to innovate and maintain close client relationships, the opportunities are substantial. Digital adoption will not only expand but also deepen. While rapid digital adoption has been evident, the next phase will focus on delivering insights and real-time service. Success will come to those who integrate the convenience of digital with the trust of human relationships.

The very notion of wealth is evolving. Financial success is being redefined to include security, legacy, and impact, rather than just accumulation. This shift creates opportunities for more nuanced wealth propositions tailored to professionals, entrepreneurs, and the growing mass affluent segment. We will see more advisory-led, hybrid models where clients are empowered to manage their finances with a trusted partner.

Moreover, competition in the industry is becoming more collaborative. With the rise of fintech and telco-driven platforms, the landscape is increasingly open and cooperative. Traditional banks can no longer succeed by operating in isolation; we must form strategic partnerships, integrate more effectively, and create ecosystems that address the full spectrum of a client’s financial needs.

Finally, talent will be the key differentiator. In a world where digital technology levels the playing field, it is our people who create a true competitive edge. Banks that invest in digitally savvy, client-focused teams will lead not only in numbers but in trust and relevance. In essence, we are transitioning from transactional banking to relationship-led, insight-driven financial experiences. This shift is already underway, and I am excited to be at the forefront of this transformation.

Synergyzer: What role does Pakistan play in the Bank’s overall strategy for the Affluent business, and what growth opportunities do we see in this market?

Saadya Riaz: Pakistan is a key market in our Affluent Business strategy, offering significant growth potential. The expanding affluent and emerging affluent segments, including a growing number of high-net-worth individuals and a rising middle class, are driving strong demand for comprehensive wealth management services. Our strength lies in delivering personalised, insight-driven advisory solutions tailored to this sophisticated client base.

The increasing adoption of digital technology in Pakistan, presents a unique opportunity to offer seamless, intuitive banking experiences that cater to both tech-savvy clients and those who value traditional branch services. In 2021, we launched a digital platform enabling clients to transact and access services without visiting a branch, achieving a service adoption rate of 78% and a mobile adoption rate of 66%. We also introduced an Employee Banking platform to support corporate clients’ ecosystems, with 60% of new-to-bank clients onboarding digitally—a figure set to grow.

Moreover, there is rising demand for customised investment products aligned with clients’ financial goals and risk profiles. By expanding our range of bespoke solutions and forging strategic partnerships with local and international financial institutions and fintechs, we aim to broaden our reach and enhance service offerings within Pakistan’s affluent segment. Pakistan remains central to our affluent business strategy, presenting numerous opportunities for growth and innovation.

Synergyzer: How are you using data and analytics to personalise experiences and guide clients across different life stages?

Saadya Riaz: Digital transformation is not merely enhancing convenience; it is fundamentally reshaping how we serve, engage, and grow our retail customer base. At Standard Chartered, we view digital as a critical enabler of personalised, insight-driven banking, particularly in wealth management, where we have established ourselves as the leading wealth advisory bank in Pakistan. Being the first bank in the market to establish Wealth Management hubs, our relationship managers are trained to look at a client’s portfolio from the perspective of wealth creation, growth and legacy.

We are leveraging technology to transcend traditional transactional banking. What truly sets us apart is our ability to combine digital agility with the strength of our global network. Operating across some of the world’s most dynamic growth markets, we possess unique understanding into investment trends and emerging opportunities. These insights are especially valuable to Pakistan’s affluent and emerging affluent segments.

Our digital engagement is meaningful because it offers more than just seamless access; it provides intelligent, subjective service underpinned by institutional trust. Whether assisting a young professional in building their first investment portfolio or supporting a high-net-worth individual (HNWI) in navigating global markets, we utilise data, digital channels, and deep advisory expertise to remain relevant at every stage of the customer lifecycle.

Looking ahead, digital will continue to be our frontline in both client acquisition and engagement, not only to serve our clients better but also to empower them to grow alongside us.

Synergyzer: As a leader, how do you foster agility and innovation in a highly regulated environment?

Saadya Riaz: Navigating agility and innovation within a highly regulated environment requires a strategic and balanced approach. At Standard Chartered Pakistan, we do not see compliance as a limitation but as a foundation for creative problem-solving. We empower our teams to experiment within regulatory boundaries, equipping them with the autonomy, tools, and training they need to innovate responsibly.

To achieve this, we leverage advanced technologies like data analytics, AI, and machine learning to streamline processes and enhance decision-making, ensuring we remain agile while maintaining compliance. Our continuous learning and development programs keep our teams updated on the latest regulatory changes and industry best practices, aligning our innovative efforts with evolving standards.

Moreover, we actively collaborate with regulators and industry bodies, anticipating regulatory shifts and contributing to shaping a conducive environment for innovation. By fostering a culture that values feedback and iterative improvement, we refine our approaches to meet regulatory standards while driving innovation.

This strategic integration ensures that Standard Chartered Pakistan remains agile and innovative, delivering exceptional value to our clients while upholding the highest standards of regulatory integrity.