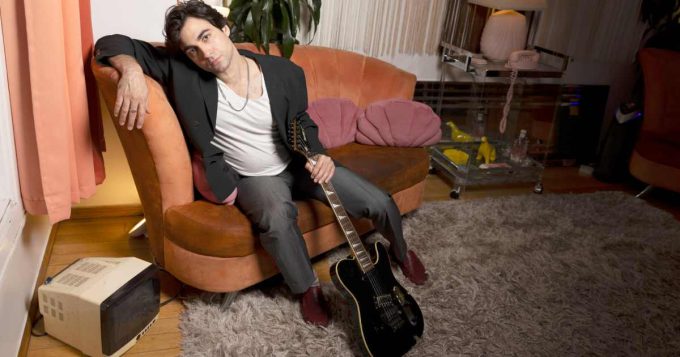

With over 30 years of experience in digital payments and commerce. Nagesh Devata is no stranger to building bridges between markets, industries, and opportunities. As Senior Vice President at Payoneer, leading the company’s business across the Asia-Pacific region. He has played a pivotal role in expanding access to financial tools that empower small businesses to think and operate globally. From key positions at PayPal and Mastercard to his current leadership at Payoneer. Nagesh brings sharp strategic vision and deep regional insight to the evolving world of cross-border trade, driven by a belief that when small and medium businesses thrive, entire economies follow.

Synergyzer: How are small and medium-sized businesses (SMBs) in Pakistan and the broader region adapting to the changing landscape of global trade and payments?

Nagesh Devata: SMBs in Pakistan and across the APAC are demonstrating remarkable agility as global trade diversifies and digitisation accelerates. In Pakistan alone, there are approximately 5 million SMEs, contributing 40% to the country’s GDP and 25% to exports. With the outstanding SME debt financing portfolio growing to Rs. 478 billion by September 2024, according to the State Bank of Pakistan and SMEDA.

Pakistan’s digital economy is experiencing strong growth as businesses increasingly leverage online platforms to connect with global customers and optimise cross-border transactions. This expansion is powered by Pakistan’s strategic advantages. A young, digitally fluent population, widespread technology adoption, and an impressive pool of English-proficient professionals.

The country’s talent quality, combined with advanced cloud solutions and digital collaboration tools. Enables businesses, entrepreneurs, and gig workers in Pakistan to integrate with global supply chains. As Western market demand continues to rise. Pakistan’s digital entrepreneurs are uniquely positioned to capitalise on cross-border opportunities and accelerate their international growth trajectory.

As a result, cross-border businesses are seeking greater efficiency, transparency, and reliability. Where traditional banking systems often fall short for SMBs. Cross-border businesses face significant challenges with traditional banking systems that don’t serve SMBs effectively.

International bank transfers require costly overseas accounts that are often difficult for smaller companies to establish. These traditional methods create multiple barriers: hidden fees, transparency issues in money movement, higher FX costs, and burdensome documentation requirements. Today’s global businesses demand international payment solutions that deliver greater efficiency, complete transparency, and absolute reliability.

At Payoneer, we’re proud to be a partner in this transformation. Providing the financial infrastructure that empowers SMBs to transact globally with confidence. Our goal is to connect small and midsize businesses (SMBs) and entrepreneurs. Especially in emerging markets, to the fast‑growing digital economy.

Our platform is designed to break down barriers, enabling SMBs, entrepreneurs, content creators, game developers, gig workers, and e-commerce sellers. To connect with clients, vendors, and partners in over 190 countries and territories.

By using Payoneer, customers can receive payments in multiple currencies directly into Payoneer’s virtual accounts. Making it easy to receive funds from marketplaces worldwide and enabling SMBs to be “local” to their customers, regardless of where they are. Additionally, Payoneer supports withdrawing money to a local bank account at competitive fees. Providing customers with the flexibility to access funds conveniently.

Synergyzer: What sets Payoneer apart from traditional banks and other fintechs for cross-border payments?

Nagesh Devata: Payoneer’s core strength lies in being a one-stop, business-grade financial platform purpose-built for the needs of global SMBs. The traditional banking system has made it prohibitively complicated for SMBs to navigate changing regulatory frameworks.

Local and global banking infrastructure, currency conversion costs, fraud risks, cross-border supply chain payments. And ensuring seamless payment experiences for their customers or vendors worldwide. Each of these is both time and resource-intensive.

If you aren’t a large global enterprise. You don’t stand a chance of making it to the starting gate, much less competing. Payoneer addresses these pain points by offering a multi-currency financial stack that is accessible, secure, and efficient. Simplifying cross-border transactions and empowering businesses to operate globally with greater ease.

We support transactions in nine leading global currencies. And enable businesses to track and monitor their international payments seamlessly through our user-intuitive dashboard. Our regulatory footprint spans global financial hubs, including the US, UK, Ireland, Hong Kong, Japan, Australia, and Singapore, ensuring robust compliance and security.

With local staff in 35 countries and support in over 20 languages. We combine global reach with deep local expertise, helping SMBs navigate the complexities of international commerce.

As of March 31, 2025, Payoneer’s ~2 million active users trust us with $6.6 billion in customer funds. In 2024, we processed approximately $80.1 billion of total volume into the Payoneer network.

(Note – Data from Payoneer Q1 2025 Earnings Report)

Synergyzer: What major trends are you seeing in digital payments for exporters and SMBs in Pakistan and APAC?

Nagesh Devata: The digital payments landscape is evolving rapidly, with several key trends shaping the future for exporters and SMBs. First, there’s a clear move towards multi-currency solutions. Enabling businesses to transact in the currencies of their choice and manage FX risk more effectively. Second, compliance and security are top priorities. With businesses seeking cross-border payments partners who can provide peace of mind in an increasingly dynamic environment. Third, there’s growing demand for integrated platforms. That streamline everything from ease of monitoring and access to funds to managing business cash flows.

Payoneer is at the forefront of these trends. We’ve invested heavily in our technology, compliance infrastructure, and customer support. To ensure we’re meeting the needs of our customers in Pakistan and across APAC. Our platform is continuously updated to reflect evolving market dynamics. We work closely with local partners to tailor our solutions to regional requirements.

The company saw strong growth in APAC, though its highest share of revenues was reported in Greater China. However, the company saw its fastest growth in its APAC segment. Which grew 31% on the back of growing B2B transactions, merchant services, and payroll payments.

In 2024, Payoneer delivered approximately $978 million in revenue, representing 18% revenue growth year-over-year.

- Asia-Pacific revenue was approximately $187 million, an increase of 31% year-over-year

- In the fourth quarter of 2024, Asia-Pacific revenue was approximately $53 million, an increase of 31% year-over-year

Synergyzer: How does Payoneer use technology and innovation to simplify cross-border payments? And what is your approach to compliance and security?

Nagesh Devata: Compliance and security are foundational to our offering. Our Know Your Customer (KYC) and Customer Due Diligence (CDD) processes are managed through a proprietary infrastructure. They are supported by dedicated teams. Combining automated tools and operational processes with regular audits and reviews to test and monitor for compliance.

We have also built a sophisticated risk management infrastructure, leveraging machine learning-based fraud typologies. To address the risks of digital commerce and a global risk management platform. To manage the risks of supporting tens of billions of dollars of volume in over 7,000 trade corridors globally for millions of platform participants.

Synergyzer: Can you share highlights from Payoneer’s performance in 2024 and what drove this growth?

Nagesh Devata: Absolutely- 2024 was a milestone year for Payoneer. Reflecting both our strong execution and the trust that global SMBs place in our platform. We delivered $262 million in revenue in Q4 2024, representing 17% year-over-year growth, and saw customer funds on our platform increase by 9%.

For the full year, our core business revenue grew 15% (excluding interest income), underscoring the resilience and scalability of our business model. Several factors contributed to this performance. First, we continued to diversify our customer base and product offerings. Supporting not just freelancers and digital entrepreneurs but also a rapidly expanding segment of exporters, B2B service providers, and e-commerce merchants.

We’re seeing SMBs in emerging markets like Pakistan not just adapt but thrive by leveraging digital platforms to access new markets. Our investments in technology, local customer support, and infrastructure have enabled us to meet these evolving needs. While our financial strength allows us to keep innovating for the future. Ultimately, our 2024 results reflect our commitment to empowering SMBs everywhere to do business globally with greater ease, security, and confidence.

Synergyzer: How does Payoneer help Pakistani businesses access new markets and manage multi-currency transactions?

Nagesh Devata: Payoneer provides Pakistani businesses with multicurrency virtual accounts in over 9 leading global currencies and reach customers in more than 190 countries and territories. Our platform enables users to receive payments in multicurrency receiving accounts.

Allowing them to get paid as if they were local to their customers, regardless of where they are. This means businesses can bill clients in their preferred currency, manage FX conversions at competitive rates, and withdraw funds to local bank accounts in PKR. By simplifying the complexities of cross-border payments, we help Pakistani SMBs focus on growth and innovation, rather than administrative hurdles.

Synergyzer: Could you share an example of how a Pakistani SMB can benefit from Payoneer’s solutions?

Nagesh Devata: If you’re an entrepreneur or operating a small consumer or service business in an emerging market like Pakistan, tapping into overseas demand and markets is critical for business growth.

Payoneer was purpose-built to solve this challenge for SMBs. We serve customers in emerging markets that other players can’t or won’t. Because we have spent nearly two decades building the financial and technical infrastructure that helps us, our customers, and our marketplace partners manage these risks effectively.

Payoneer’s “Request a Payment” solution enables SMBs in Pakistan to easily generate a payment link through our platform and send invoices and receive funds from clients in 190+ countries and territories. Clients can pay through multiple methods, including debit and credit cards, ACH debit, direct bank payments, and local transfers. This streamlines invoicing with document attachment capabilities, automatic payment reminders, transparent tracking, and integration with accounting systems – all designed to accelerate payment cycles and improve cash flow.

Our virtual receiving accounts in world’s leading 9 currencies like USD, Euro, Yen, Dirham, to name a few. They enable businesses, ecommerce sellers, and gig workers. To accept payments from global customers, vendors, and marketplaces in multiple currencies across borders. This allows SMBs to operate virtually in international markets regardless of their geographical location.

We focus on ease, speed, and convenience through our secure platform with competitive FX rates, supporting SMBs to optimise their business operations and cash flow. Plus, withdrawing funds to local bank accounts is convenient and cost-effective, giving customers flexibility in accessing their funds.

Our user-intuitive dashboard allows decision makers, entrepreneurs, gig workers, content creators, and ecommerce sellers to track and monitor transactions with complete transparency, with no hidden fees and competitive FX rates to support businesses. Payoneer has nearly 100 banking and payment service providers, as well as many global marketplace partnerships.

Synergyzer: How does Payoneer ensure reliable and compliant services in Pakistan and other emerging markets?

Nagesh Devata: Payoneer works closely with local regulators in regional markets to ensure our services remain reliable and fully compliant with all relevant regulations.

Synergyzer: What initiatives does Payoneer have to empower local exporters and SMBs in Pakistan?

Nagesh Devata: Pakistan holds a strategic position for Payoneer as a priority country, primarily catering to outsourcing, e-commerce sellers, marketplace sellers, gig workers, and service export businesses.

The service export market in Pakistan is experiencing rapid expansion. Payoneer is optimistic and believes that it is well-positioned to capitalise on this growth and strategically respond to the strong surge in businesses in the domains of tech and programming, software-as-a-service (SaaS), digital marketing and sales, gaming studios, e-commerce exporters, and marketplace sellers’ sectors in Pakistan.

We are committed to empowering SMBs and exporters through a combination of resources and community engagement. We regularly host knowledge led sessions with industry experts. Networking events like VIP Connects, XBorder Excellence Awards, and our global flagship event Payoneer Forum to promote networking within the community. Support growth and access to industry experts and access to global marketplaces to help businesses stay informed about the latest trends in global trade and payments. Our customer success teams provide localised support in Urdu and English, ensuring that users get the guidance they need.

Synergyzer: What innovations or new services can we expect from Payoneer? And what advice do you have for Pakistani SMBs expanding globally?

Nagesh Devata: We believe that innovations like artificial intelligence will continue driving the evolution of the fintech industry, as systems get more efficient and as purchasing patterns evolve. But what makes or breaks a fintech is trust between payers and receivers, customers and financial institutions, and amongst the ecosystem of partners, regulators, and governments.

Trust is even more important when borders are crossed, and multiple currencies, jurisdictions, and institutions are involved. Building this trust is most critical now, when both finance and tech companies can have a bad reputation. Companies with branded and trusted relationships with customers, like Payoneer, can thrive.

Payoneer continues to keep pace with the market by deploying artificial intelligence capabilities within our platform. These include services that could improve our customer service, enable better KYC accuracy, and help reduce fraud in transactions. We will continue to explore ways to integrate AI so that we can provide a seamless customer experience.

For SMBs in Pakistan looking to expand globally first, a comprehensive understanding of local regulations and compliance requirements is essential to navigate legal complexities and fit international business standards. SMBs do not have the same resources as global mega-corporations have, so they need to find trusted partners to help them meet their local needs.

Second, establishing a reliable and efficient supply chain payment system is crucial to managing logistics effectively and meeting varying demand patterns across borders. A flexible and adaptable business strategy is also vital to respond to dynamic global market conditions and evolving customer preferences. Leveraging digital e-commerce platforms is one of the best ways for SMBs to grow their businesses by transcending geographical boundaries. Tapping into these platforms means entrepreneurs can harness global e-commerce networks and reach wider markets in a way they’ve never been able to before.