The IMF Review of February 2020 states that the economy of Pakistan is on the path of gradual recovery. The current government has taken corrective measures to strengthen the economy and it has had a visible impact[i]: trade deficit has gone down by 30%[ii]; textile export – particularly to EU – has improved and shows volumetric growth of 40%[iii]; and the national carrier, PIA, posted 30% increase in revenue during the first six months of 2019[iv].

Since advertising expenditure (adex) for mass media as well as consumer spending gets influenced by the health of the economy, anticipated economic recovery will allow adex to increase proportionately. Although all this is expected to happen eventually, as of now the industry is suffering.

Last year – 2019 – particularly was not good for advertising, yet the negative growth in adex was not entirely due to economic factors. The absence of an unbiased and independent regulatory body that keeps a check and balance on the media industry and the advertising system also played a role. In this situation, some of the top agencies used the opportunity and molded the whole industry to benefit themselves. In maximizing their profits they damaged the basic ecosystem of the industry resulting in layoffs and even business closures.

Moreover, media owners also played their catalytic role in bringing the system down through unprofessional practices including engaging in price wars and submitting to the whims and wishes of media buying houses, to the extent that eventually even a little jerk could bring down their businesses towards collapse.

TRACKING ADEX GROWTH

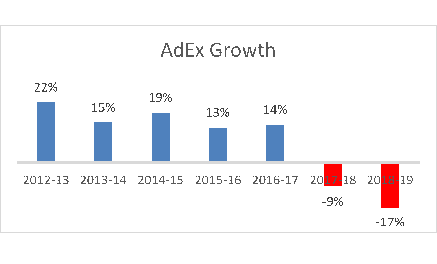

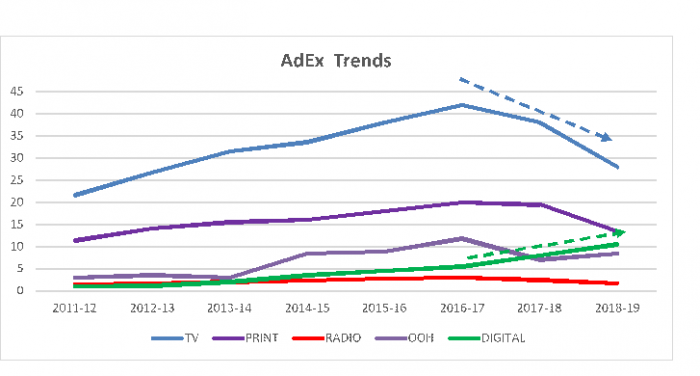

If we analyze the overall spending trend over major media for the last 8 years, we see that up until 2017, the overall adex was increasing. However it became negative in the past two years.

TV had the highest adex share which, once it was cut down, impacted the whole pie. Amongst all the major media as illustrated in the chart below, digital is the only exception which has been growing continuously for the last 5 years. Yet even though the adex for digital was rising, overall it remained lower compared to previous years.

Some of the reasons include:

- Buying airtime on TV is more expensive compared to advertising on digital. So advertisers with relevant target audience on digital media have, to a major extent, moved their budgets there.

- Further, there is an influx of smaller advertisers who do not spend on TV, but are actively involved in creating tactical campaigns for digital platforms. Meanwhile, major advertisers are spending on multiple digital touch points including Facebook, YouTube, Instagram etc. at the same time, expanding their digital footprint alongside maintaining presence on TV.

Small advertisers like Lal Qila take to social media platforms like Facebook, Instagram etc. to execute tactical campaigns to increase short term sales during events such as PSL.

In the digital world, media owners i.e. publishers and digital platform owners are categorized as ‘suppliers’, since they ‘supply’ ad space to advertisers. Due to user demand, internationally, these vendors have optimized their products to maximize profits, taking the lion’s share out of the total digital adex. For example, ‘Masthead’, a digital billboard, is one of Google’s products for YouTube, and was launched in 2016 for only USD 4,000. A year later Google doubled the amount and then, with further smaller jumps, the value reached USD 14,400 – pricier than a quarter of a front page insertion in Pakistan’s top-of-the-line national newspapers.

Initially there were 365 mast-heads available – one for every day. However, with optimization the product was made target audience relevant, expanding the inventory. Now, instead of displaying one ad a day, multiple groups can be targeted at the same time through YouTube. But it should be noted that the digital medium cannot be used as a substitute for TV since the latter has penetration across all age groups and SEC’s whereas digital platforms can target only specific demographics. Moreover, the readings from a recent research conducted by a local agency (CCS 2018) show that TV impacts the whole brand funnel more comprehensively as compared to digital, which has limited reach.

AD EXPENDITURE IN TOP MEDIA CATEGORIES

- Television

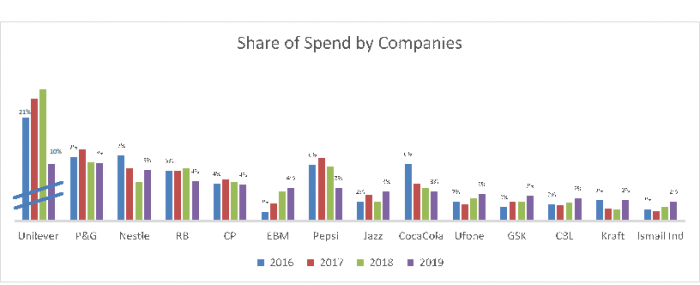

Advertising categories that are elastic in terms of demand have shown continuous decline, some less steeply compared to others.

This is so because advertisers have reduced their ad spends and hence, one can see a 26% dip in overall TV adex. Due to overall decrease, number of spots have gone down as well. This has allowed brands to maintain their presence, in terms of percentage, even though they were utilizing lesser money. Hence, in terms of share-of-spend (SOS), advertisers are standing at almost the same position as they were two years back. In fact, some of the advertisers were able to increase their SOS as well. This is evident by the following graph.

2. Out Of Home

After the Supreme Court of Pakistan banned OOH billboards and hoardings on the streets, the industry has been experimenting with various options, which mostly include electronic billboards on buildings, building wraps, mall brandings etc. Certain retail brands like J., Habitt, Khaadi etc. have already started using Surface Mounted Devices (SMD) along with shop signs.

3. Print

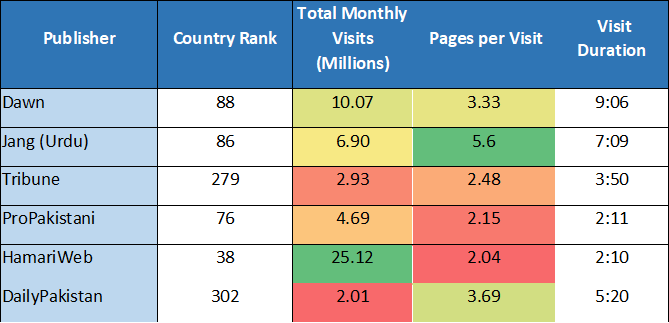

Adex for print publications such as newspapers has been shrinking as well and has lost substantial share to digital media. One major reason is also that the print media industry has been transforming itself into digital platforms and in doing so, shifted a good number of readers to those platforms as well. However the print medium still holds significant reach of more than 20% in Pakistan. Following are some numbers for local news portals and hybrid portals.

4. Radio Advertising

Radio listenership is also going down albeit at a slower pace, with net reach of 10% in Urban Pakistan as compared to 14% five years back.

WHAT THE FUTURE HOLDS

There are numerous factors at play which will transform media globally and consequently affect Pakistan too. One very strong factor is the changing audience preferences. For example Gen Y is more attached to Facebook whereas Gen Z likes to spend more time on Instagram and TikTok.

Another factor is the evolving internet speed. With the launch of 5G there will be another wave of transformation on the supply side of the business as there was when 3G and 4G entered the market, where the technologies impacted are expected to become much faster and in real-time for instance, self-driving cars, VR-based drone operations etc.

Whether TV gets its full glory back or not, irrespective of economic conditions, is still a question, the answer to which will be visible in the near future. Yet, if local mediums fails to evolve, they will fail to survive let alone prosper. Hence it is important that the industry stays alert for all such upcoming and unavoidable challenges.

References

[i] IMF | Statement at the Conclusion of IMF Mission to Pakistan | Press Release No. 20/51 | February 14, 2020.

[ii] SAMAA Digital | Pakistan’s trade deficit falls by 30% to $11.64b | Jan 5, 2020

[iii] Tribune | Pakistan’s textile sector jumps to full capacity production | Salman Siddiqui | February 23, 2020

[iv] ProPakistani | PIA’s Revenue Increased 30% in Jan-June 2019: Aviation Division | Ambreen Shabbir | August, 2019

ABOUT THE WRITER

Muhammad Ali is Business Analyst at Synergy Group. He can be reached at muhamad.ali@synergygroup.com.pk.